Last updated on October 9th, 2023 at 01:00 pm

RBI floating rate savings bond provides a Safer savings option for the people looking for a secured return with out the risk for their capital.

RBI Bond provides the maximum interest rate at 8.05% (July 1 to Dec 31, 2023) in the savings segment. It is the best option compared to the FD and other Savings option in the market.

As the bond is provided by Central Bank of the Country, your money is completely safe from market movements. To further understand how the bond works read this blog to the end.

Eligiblity

RBI Floating Bonds are available for subscription to Individuals and Hindu Undivided Family (HUF). Thus to invest in RBI Bond one should be

- An Individual – For individual or as an anyone or survivor basis.

- A Hindu Undivided Family – An individual for himself or on behalf of a minor as a Father/ Mother or Legal Guardian.

Note that the Non Residential Indians (NRI’s) are not eligible for making investment in RBI Bond.

For making investment PAN Number is mandatory for both individual and HUF.

Features of RBI Bonds

Before purchasing a RBI savings Bond it is important to know basic features of the scheme.

Investment Amount

- The minimum amount you can invest is Rs. 1000 and in multiples of Rs. 1000 thereafter.

- There is no maximum limit for investment.

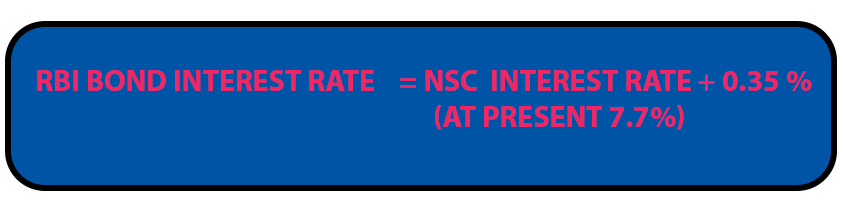

RBI Bond Interest Rate

As said earlier RBI Bonds provide the best interest rate among the savings option in the market.

RBI Bond have a Present Interest Rate at 8.05% (July 1 to Dec 31, 2023).

This bond does not provide fixed interest rate for the tenure. It is actually linked to the NSC interest rate in the market. Thus interest rate of RBI floating rate Savings Bond is derived from the Interest rate of NSC.

The interest rate is fixed 0.35% more than that of NSC. As the present interest rate on NSC is 7.7%, you can derive the Interest rate as below.

The interest is paid Half Yearly on January and July 1st for the preceding half year.

Maturity Period

RBI Floating Rate Savings Bond comes with a Maturity period of 7 Years before which you can not redeem the invested amount. Thus the RBI Savings Bond is a long term investment option.

The minimum lock in period for the Bond is less for the senior citizens and is as below.

| Age Bracket | Minimum Lock in Period |

| 60 to 70 Years | 6 Years |

| 70 to 80 Years | 5 Years |

| 80 Years and Above | 4 Years |

RBI Bond Tax

The Savings Bond does not provide any Tax Exemption. Thus the interest earned in RBI Savings Bond is Taxable under the Income Tax Act, 1961.

The Tax is deducted at source before payment to the investor.

Transferablity

RBI floating Rate Savings Bond is not Transferable between individuals. The Bond is issued in the electronic Form called Bond Ledger Account (BLA).

Also the bond cpan not be used as a collateral for availing loan with the bank. Thus the Savings Bond does not have any liquidity to it.

Pros and Cons of RBI Bond

Pros

- It provides a Safe investment option with out risk to the Capital invested.

- The Bond yields higher interest rate compared to the alternative savings option available in the market.

- The bonds are issued in digital mode, hence it is easier to keeping the investment secure.

Cons

- The Bond provides Higher interest rate. But it is not compounded to the initial investment. Thus it cancels out the higher interest rate to some margin.

- Floating Bonds are not providing fixed interest. As the interest rate is fixed by Government based on the economy, there is a chance the interest rate will be reduced in the future.

- The Liquidity of the bond is low as there is a maturity period of 7 years. And there is no option for the preclosure unless the demise of the investor.

Conclusion

Thus RBI Savings Bond is perfect for the people who want a risk free investment option and does not worry about the liquidity of the investment.

Though it provides higher interest rate, the interest is not compounded to the initial investment like other peer investment option in the market.

Thus it is suitable for the people who want a safe investment option with low risk appetite and does not interested in compounding their investment.