The Atal Pension Yojana (APY) is a government-backed pension scheme launched in 2015 to provide financial security to in the unorganized sector. Regulated by PFRDA, the scheme guarantees a fixed monthly pension of ₹1,000 to ₹5,000 after the age of 60 based on the subscriber’s contribution.

Eligibility for Atal Pension Yojana

- Indian citizen

- Age – 18 to 40 years old

- Savings bank/ Post office account

- Not be an income tax payer (as per rules effective Oct 1, 2022)

Key Features of APY

1. Guaranteed Pension

Subscribers can choose a monthly pension of:

- ₹1,000

- ₹2,000

- ₹3,000

- ₹4,000

- ₹5,000

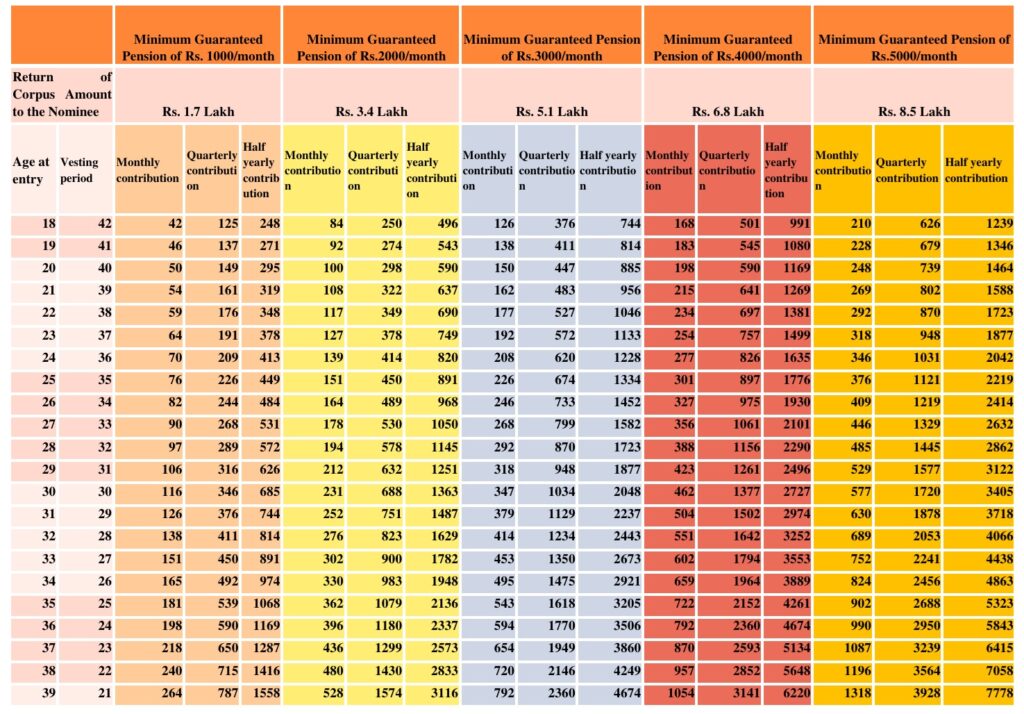

2. Contribution Based on Age

Contribution is based on the age of the subscriber as given below.

3. Auto-Debit Payments

Contributions are automatically debited monthly, quarterly, or yearly from the subscriber’s account.

4. Nomination

Nomination is compulsory, and the spouse is the default nominee.

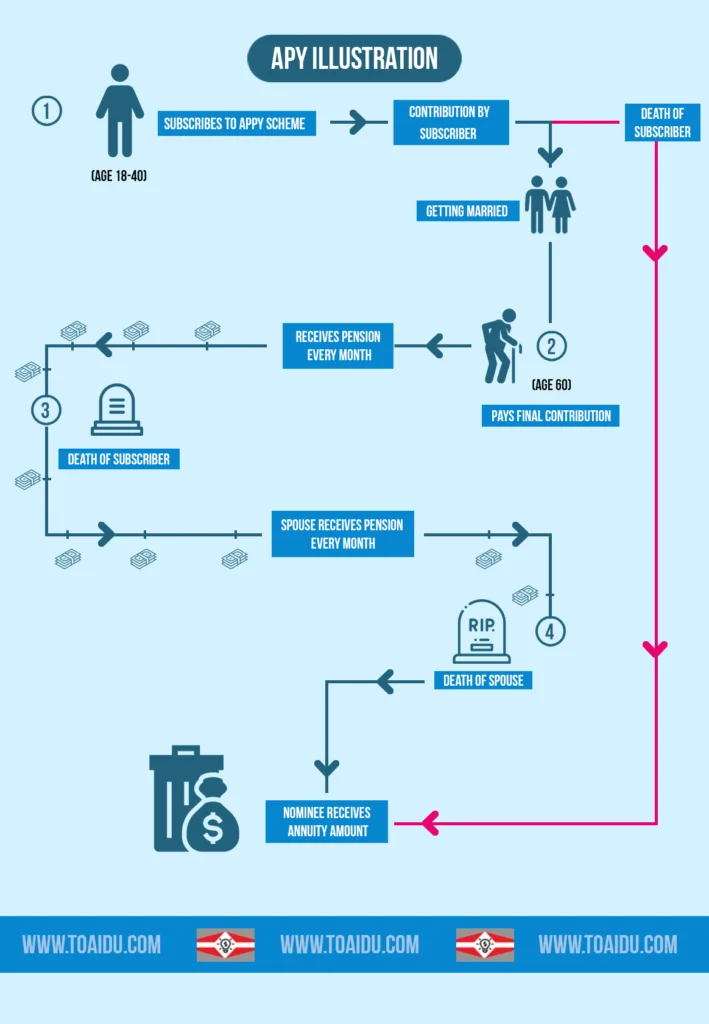

5. Benefits for Spouse and Nominee

- Spouse can continue contributions or receive pension upon subscriber’s death.

- After both subscriber and spouse die, the corpus goes to the nominee.

Benefits of Atal Pension Yojana

- Guaranteed lifelong pension after age 60

- Low-risk, government-backed scheme

- Supports workers without EPF/ESIC

- Tax benefits under Sections 80CCD(1) and 80CCD(1B)

- Financial protection for spouse and nominee

Exit Rules

- Before 60: Voluntary Exit is allowed in case the subscriber requests.

- After 60: Guaranteed monthly pension as per chosen slab until the death of the subscriber.

- After subscriber’s death: Pension to spouse; corpus to nominee afterward the death of the spouse.

How to Enroll

You can join APY through:

- Banks and post offices

- Net banking / mobile banking

- Payment banks (Airtel, India Post, etc.)

Documents needed: Aadhaar, mobile number, savings account, APY form.

Conclusion

APY is an affordable and safe pension option that ensures guaranteed income after retirement. Designed for non-taxpayers aged 18–40, the scheme provides long-term financial security with minimal risk and assured lifetime pension benefits.