Last updated on November 20th, 2023 at 02:38 pm

India as a developing country is facing so many struggles in the path. But the most important issue at hand is providing quality education to the financially weaker students. Thus, to provide a quality education to the economically weaker section Central Sector Interest Subsidy Scheme (CSIS) is introduced.

The scheme provides subsidy to the students on the educational loan availed by the student. Hence the financial burden on the student’s family is reduced with this scheme.

What is Central Sector Interest Subsidy Scheme (CSIS)?

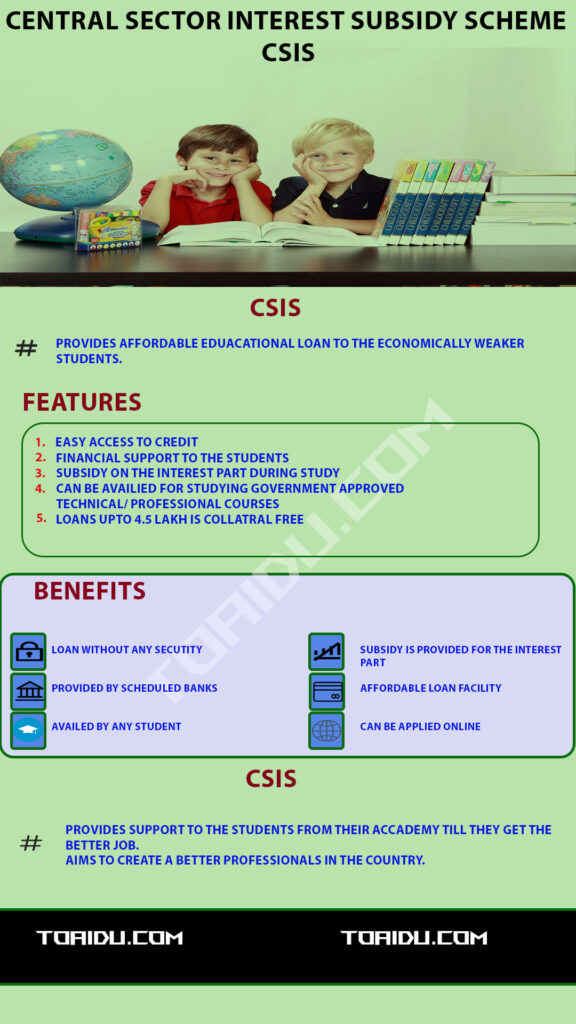

Central Sector Interest Subsidy Scheme (CSIS) is a Educational Loan Scheme which enables affordable and Collateral Free credit facility to the Economically weaker section.

Thus, CSIS scheme provides easy access to the credit for the students who are enrolled in government approved professional/ technical courses.

The scheme also provides interest subsidy covering interest portion of the loan during the moratorium period.

Eligibility for CSIS Scheme

The scheme is specifically made for the economically weaker section of the population. Hence the student should have the following eligibility to avail the benefits of CSIS scheme.

- Student with the Annual Family Income up to 4.5 Lakhs. There should be a proper proof for the income of the family for availing the benefits under this scheme.

- Students who enrolled for studying professional/ technical courses which are approved by the respective authority of the profession.

- Education Loans taken under IBA Model Education Loan Scheme.

- The Educational Loans availed without any collateral or third-party security up to Rs. 7.5 Lakh.

- The subsidy can be availed only once per candidate. Thus, the student can avail the subsidy for Undergraduate or for Postgraduate but not for both.

Features

The following are the features of the Central Sector Interest Subsidy Scheme.

- It provides collateral free educational loan for the students from the economically weaker section.

- The scheme aims to create a better qualified Professional/ Technical personals in the nation.

- The interest payable on the moratorium period is borne by the Government of India. Thus, the interest payable during the moratorium period is given as the subsidy to the banks.

- But after the moratorium period is over the both the interest part and the principal part should be covered by the student.

- The subsidy under the scheme is disbursed to the banks on half yearly basis. The disbursement is done by the Human Resources department, Government of India.

- This scheme is adopted by all the Scheduled Banks and is integrated with the banks normal Educational Loan Scheme.

- Students can avail higher amount of loan as per their requirements. But, the subsidy is provided for the maximum loan amount of Rs. 10 Lakh.

- Interest Subsidy will not be paid if the student discontinues from his studies or who are expelled from the Institution on disciplinary or academic grounds.

Benefits of CSIS Scheme

The Central Sector Interest Subsidy Scheme is having the following benefits.

- It provides affordable and easy access to the credit facility for the economically weaker section.

- As the educations is seen as an investment towards the future, the loans cannot reject based on their family income and the students current financial status.

- The interest subsidy during the moratorium period reduces the financial burden on the student.

- There is a nodal bank (Canara Bank) that monitors the funding under this scheme and distributes the subsidy to the banks. Thus, the entire data regarding loan disbursement, interest subsidy provided are all monitored by the Government indirectly.

- Students can easily apply for the loan under CSIS scheme through Vidya Lakshmi Portal for the bank of their choice.

Conclusion

Central Sector Interest Subsidy Scheme (CSIS) is a simple and yet a unique scheme that aims at providing affordable education to the students.

Moreover, it provides the financial support to the students not only during their study but until they get the job.