Last updated on October 11th, 2023 at 03:58 pm

Kissan Vikas Patra (KVP) is a long term savings scheme that double you are invested amount with the fixed interest rate compounded annually. And KVP certificate is introduced to create a long term savings scheme for the people.

As KVP scheme is backed by the central government it is a risk free investment option for the people with low appetite for risk.

If you are looking for a long term and safe investment with higher interest rate KVP is a good option for you. But read this post completely to understand the Scheme, then make a decision for yourself.

Eligibility

The people should meet the following eligibility criteria for making an investment in KVP.

- Person who attained the age of 18.

- For the minor above 10 years of age the account can be opened in a single name.

- For the Minor below 10 years of age, the guardian can open and operate the account on behalf of the minor.

- Joint account can be opened with a maximum of 3 Joint Holders.

Documents Required for invest in KVP

You can make an investment in Kisan Vikas Patra certificate through any branch of the Post Office.

But for making investment you need to produce the following documents to the Post Office Branch.

- Duly filled application form for KVP (Can be obtained from the post office branch or from the official website of India Post) along with the following documents.

- Recent Passport Size Photograph.

- Any one of the six Officially Valid Documents (OVD). (1.Passport 2. Driving license 3. Voter’s ID card 4. Job card issued by NREGA signed by the State Government officer 5. Letter issued by the National Population Register containing details of name and address 6. Aadhar ).

- An account can be opened by guardian for the mentally unsound person. The medical certificate should be provided with the application in such cases.

Deposit Amount

- You can make a deposit from Rs. 1000 and in multiple of 100.

- There is no maximum limit on amount that can be invested.

- There is no limit for the number of accounts you can open.

Types of KVP Certificate

There are three types of KVP Certificate you can invest in based on the payment in at the maturity of the term.

- Single Holder Type Type Account – It is opened for individual for himself or for on behalf of the minor. The invested amount is paid to the individual upon the maturity.

- Joint A Type Account – Account is opened jointly for maximum of three people. The amount is payable to all the account holders or to the survivor on maturity.

- Joint B Type Account – Account is opened jointly for maximum of three people. The amount is payable to any of the account holders or to the survivor on maturity.

Benefits of KVP

KVP is a good investment option available for the public at present with high interest rate and provides security to the invested amount and the interest payment.

The scheme is widely popular among the investors and the public because of the benefits it provides. The following are some important benefits provided by KVP.

Interest Rate and Taxation on KVP

Kisan Vikas Patra bears a interest rate of 7.5% at present and compounded annually.

Thus investing in KVP has brings compounding into the investment and brings more return to your deposit at the maturity.

Also the return from the investment at the maturity is exempted from Tax Deduced at Source (TDS).

Maturity Benefits

The maturity period of KVP is not fixed and varies with the interest rate at the time of investment.

The maturity amount in KVP is double that of the invested amount. Thus with the increase in interest rate the maturity period will reduce and vice versa.

Kisan Vikas Patra (KVP) has a maturity period of 115 Months (Nine Years and Seven Months) as with the current interest rate of 7.5%.

At the time of maturity you can submit a request for encashment of KVP certificate along with the certificate issued to you during the investment.

Loan against KVP

Amount invested in the Kisan Vikas Patra certificate can be used as a security for availing loan with any financial institution.

KVP is accepted as a collateral security for availing any secured loan from banks.

Premature Withdrawal

The premature withdrawal of the invested amount is possible only on certain situations as follows.

- On the death of all the account holders.

- On the request of Gazetted Officer on the account of forfeiting of pledge.

- When ordered by the Court.

In these cased there is no penalty levied for closure and the interest is paid as a simple interest for the months it was held with post office.

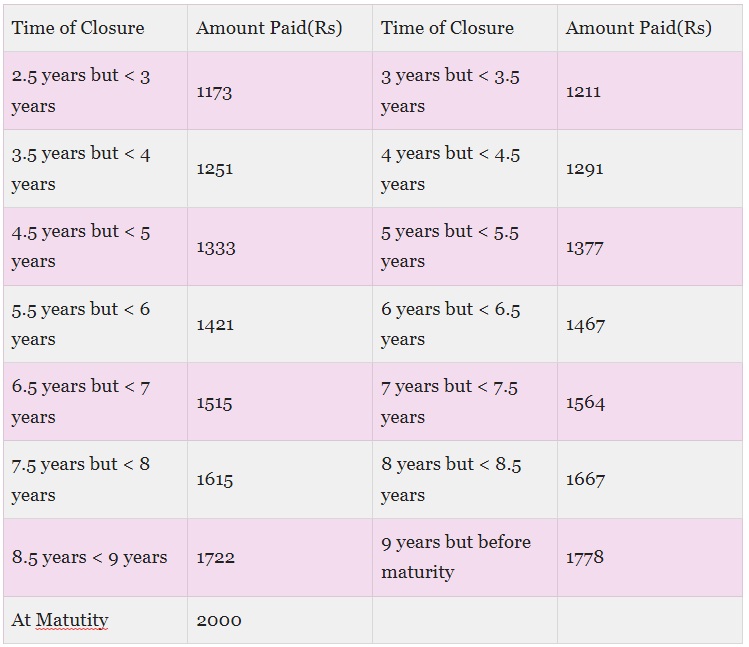

- The account can be closed for any other reason only after 18 months from the date of purchase of certificate. But the amount paid to the customer is as below.

Transfer of KVP account

An account can be transferred between on person to another person subject to the following conditions.

- On the death of the account holder or the one of the account holder in the joint accounts the certificate will be transferred to the legal heir or to the surviving account holder as the case maybe.

- On the order of the court the account will be transfered

The KVP account can also be transferred between one branch of post office to other branch by giving request to the branch.

Conclusion

Kisan Vikas Patra (KVP) is one of the most popular savings scheme for the investors who wants a risk free return and are able to stay invested for longer duration.

It provides the best interest rate compared to the other savings option, even compared to the Fixed Deposit rated it fares well. Thus it is a good opportunity for investment if you can not afford to lose your money in other investment schemes.