Last updated on October 9th, 2023 at 01:01 pm

The bank account in India offers account holder an option to add nomination to the account. You can add nominee to all types operative accounts including Savings Account, Current Account and Term Deposit Accounts.

If you do not have any idea about what Nomination facility reading this post will clear your mind and will surely help you in understanding the concept.

What is Nomination/ Nominee?

Nomination is the process of adding someone to the deposit account to receive the amount in the account upon the death of the account holder. But it is an optional exercise done with the discretion of account holder.

The Nomination can be given by only the account holder. In case of the joint account the Nomination must be acknowledged by all the account holders.

The person appointed by the account holder to receive the money is called Nominee of the account.

Nominee is introduced solely for the purpose of simplifying the deceased settlement claim upon the death of depositor. Thus the nominee does not take away the rights of legal heirs. The Nominee merely receiving the stocks from the bank as a trustee of the legal heirs.

Though introduction of nomination facility is optional for the account holder, it is better to add Nomination to the deposit account.

Importance of Nomination

As mentioned earlier the Nomination is done to identify some one for the settlement of the amount in the account after the death of the account holder.

Nomination simplifies the process of claim settlement reduces the paper work done for the deceased claim in the deposit.

Nominee saves the time and effort of the legal heirs for the processing of claim settlement.

Rules on Addition of Nominee

The following are the important rules with respect to the addition/ modification of nominee in an account.

- The Nomination can be made by the depositor or all the joint depositors, jointly.

- Nomination can be made only in respect of a deposit which is held in the individual capacity of the depositor(s) and not in representative capacity as the holder of any office or otherwise.

- Nomination can be made in favor of only one individual. Even for Joint accounts one nominee can be added.

- You can Add/ Modify/ Change Nominee on a account any time you want. But there might be charges for Modification and Deletion of Nomination in an account.

- In the case of Term Deposit (Fixed Deposit, Recurring Deposit, etc.) the nomination will not cease upon the auto renewal at the end of term.

- In the case of Joint Accounts wherein nomination was not made at the time of opening the account, the surviving depositors can make a valid nomination upon death of one of the depositors.

- Accounts of Minor: In the case of a deposit made in the name of a minor. Nomination should be made by a person lawfully entitled to act on behalf of the minor.

- Nominee is a Minor: If nominee appointed is a minor. The account holder also need to specify the person who will receive the money on behalf of the minor. But that person should not be a minor.

Deceased Claim Process- Bank Deposit

The main objective of adding Nominee is to simplify the Deceased Claim process. Thus the settlement process for the account with and without nominee can be compared as below.

| Account With Nomination | Account without Nomination |

| The balance amount will be paid to nominee on verification of nominee identity and proof of death of depositor. Premature termination of term deposit account will be permitted at the request of nominee. | The balance amount will be paid to legal hair/s (or any one of them as mandated by all legal hairs)on verification of authority of legal hair/s and proof of death of depositor. Premature termination of term deposit account will be permitted at the request of legal hair/s. |

How to Add Nomination to Account?

With the array of benefits, if you are wondering how to add or modify nominee in your account. Here we will guide you for the same.

Adding Nominee to an account is a simple process. If you are opening a new account you can add nominee easily as all the deposit account opening forms now have the clause for addition on nomination by default.

But you did not add nominee to your account or you want to change the nominee same can be done by submitting respective application form.

Adding Nominee

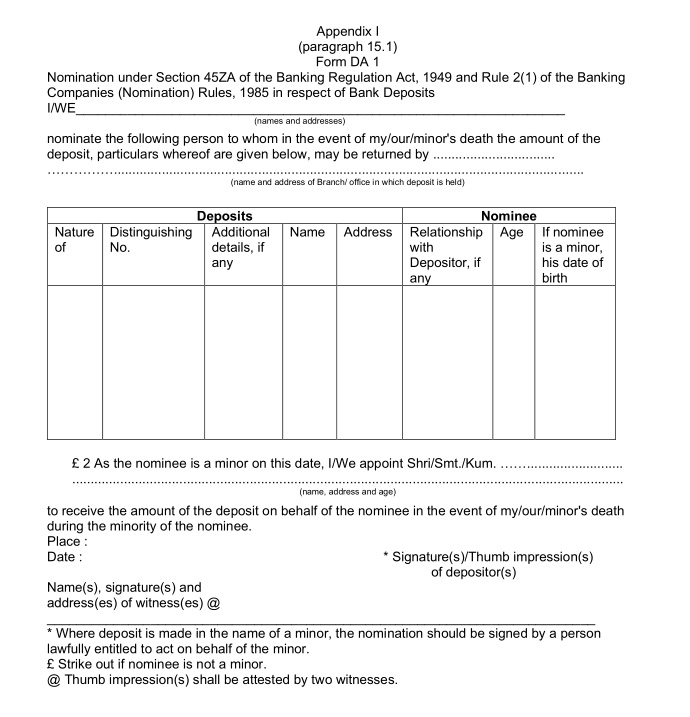

For Adding a New Nominee to an account you need to submit Form DA 1 duly filled to the bank.

Modification of Nominee

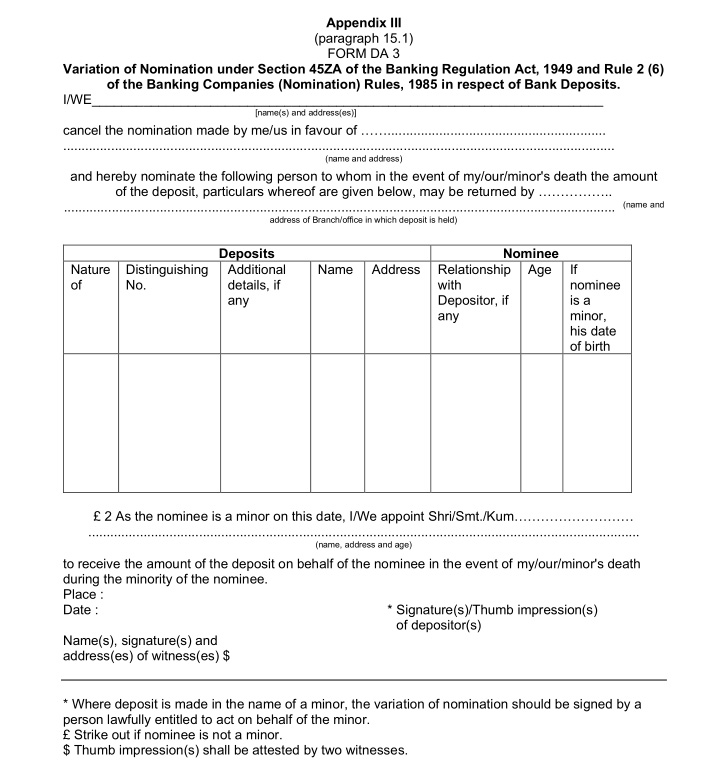

For Changing the details of nomination already provided Submit Form DA 3 to the banking official.

Deletion of Nominee

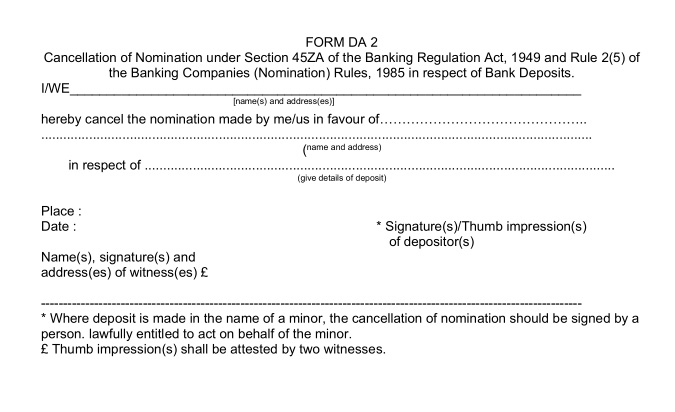

For some reason you wan to delete the nominee provided by you previously. But you have to submit the Form DA 2 to the bank for deletion of the Nominee from your account.

Conclusion

Thus in conclusion Nomination is a very good facility provided to simplify the Death Claim Process in the Deceased Account.

RBI and Banks are providing the importance of addition of nomination in and account through the financial education.

Also adding nomination to the Account will help the legal heirs of the account holder by reducing the claim time and paper work required.

But this is not a mandatory facility thus you can request for a addition of Nominee when you feel it is needed.

1 thought on “Nomination in Bank Account – Benefits and Rules”