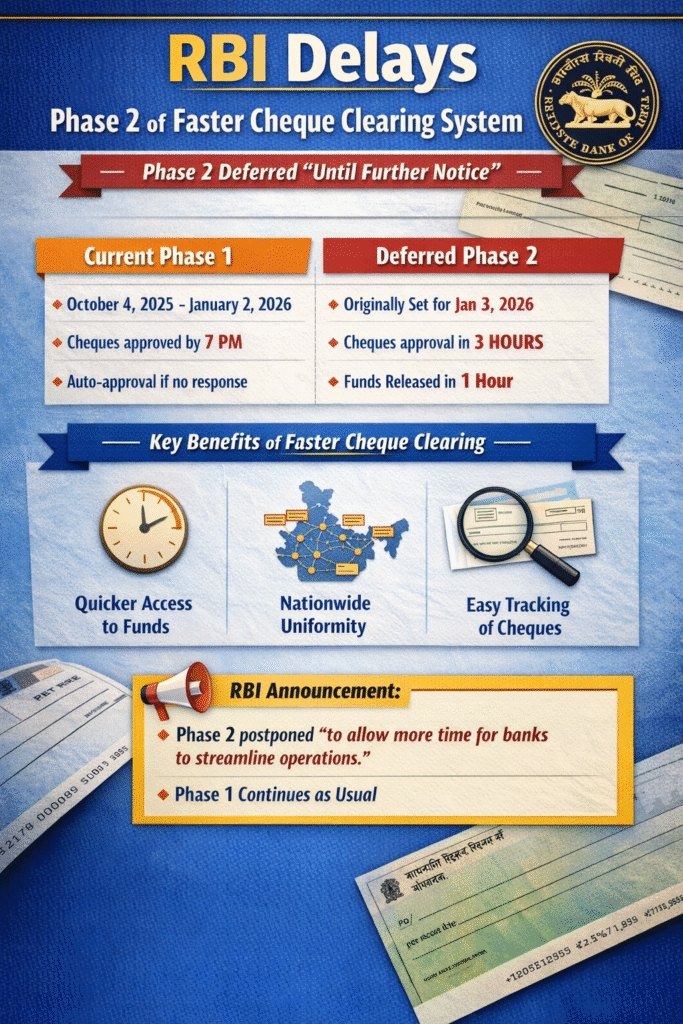

The Reserve Bank of India (RBI) has postponed the implementation of Phase 2 of the Continuous Clearing and Settlement (CCS) framework for cheque clearing, which was scheduled to take effect from January 3, 2026. The move gives banks additional time to align their systems and operations with the new, tighter timelines.

Under the proposed Phase 2 rules, banks would have been required to approve or reject cheques within three hours of receiving them. However, in a notification issued on Wednesday, the RBI stated that the rollout of Phase 2 has been deferred “until further notice”, without specifying a revised timeline.

CTS implementation – Phase 1

The RBI clarified that Phase 1 of the faster cheque clearing system, which came into effect from October 4, 2025, will continue to operate as usual. Phase 1 itself represents a major improvement over the earlier batch-based clearing mechanism, where cheque realisation often took one to two business days or longer.

With the introduction of CCS under the Cheque Truncation System (CTS), cheque processing has moved to a continuous, time-bound model, enabling much faster settlement and improved efficiency across the banking system.

What the New System Changes in Cheque Clearing?

Under the CCS framework, cheques are cleared using digital images and electronic data, eliminating the need for physical movement of cheques between banks. Instead of waiting for fixed clearing batches, banks now scan cheques and transmit images and MICR data to the clearing house as they are received.

Once the drawee bank receives the cheque image, it electronically reviews and either approves or rejects the instrument. If no response is sent within the prescribed confirmation window, the cheque is automatically approved and settled.

Original Phase-Wise Timeline

| Phase | Period | Bank Confirmation Timeline | Key Features |

|---|---|---|---|

| Phase 1 | October 4, 2025 – January 2, 2026 | Banks must approve or reject cheques by 7:00 pm on the day of receipt. If no response is sent, the cheque is automatically approved. | Continuous cheque presentation during the day, faster clearing than the earlier batch-based system, nationwide uniformity in clearing speed. |

| Phase 2 (Deferred) | Planned from January 3, 2026 | Banks would have had 3 hours from receipt of cheque image to approve or reject it (e.g., cheques received between 10–11 am to be confirmed by 2 pm). Non-response would lead to auto-approval. | Hourly settlements, near real-time clearing, funds to be released to customers within 1 hour after settlement, subject to safeguards. |

Revised Working Hours for Cheque Processing

As part of the new framework, the RBI has also revised cheque processing timings:

- Cheque presentation window: 9 am to 3 pm

- Confirmation/rejection window: 9 am to 7 pm

These changes aim to ensure smoother, faster, and more transparent cheque processing throughout the day.

Impact on Customers and Banks

For customers, the CCS framework brings several benefits:

- Faster access to funds

- Quicker payments for businesses

- Uniform cheque clearing timelines across India

- Easier tracking of cheque status across banks

This marks a shift away from the earlier system that relied on three regional RBI clearing grids in Delhi, Mumbai, and Chennai.

Conclusion

While the deferment of Phase 2 delays the move to even faster cheque clearances, Phase 1 already delivers significant improvements. The RBI’s decision provides banks with additional time to strengthen internal processes, ensuring that when Phase 2 is eventually implemented, the system remains stable, secure, and efficient.