The RBI Floating Rate Savings Bond is a government-backed investment option designed for investors seeking safe, stable returns with periodic interest payouts. Issued by the Reserve Bank of India (RBI) on behalf of the Government of India, these bonds are especially popular among conservative investors and senior citizens.

Below is a detailed overview of the RBI Floating Rate Savings Bond, covering eligibility, investment limits, interest structure, taxation, and other key aspects.

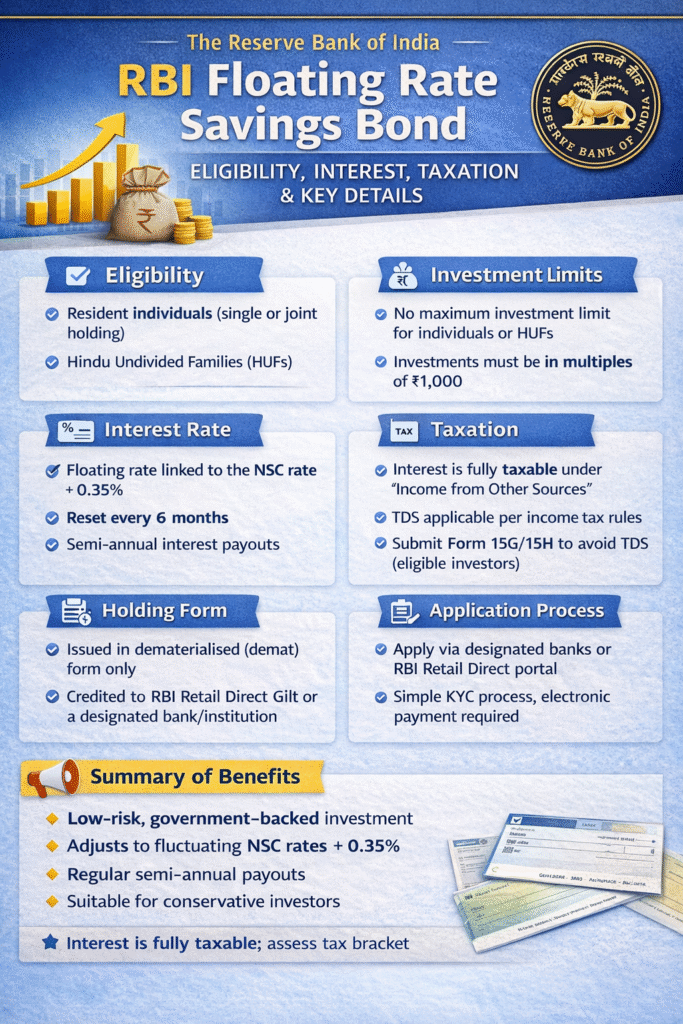

Eligibility

The RBI Floating Rate Savings Bond is open to:

- Resident individuals (single or joint holding)

- Hindu Undivided Families (HUFs)

The bond is not available to:

- Non-Resident Indians (NRIs)

- Corporates, institutions, or trusts

Investment Limit

There is no maximum investment limit for individuals or HUFs. Investors can invest any amount, subject to availability and application norms.

Issue Price

- The bond is issued at a face value of ₹1,000

- Investments must be made in multiples of ₹1,000

Interest Rate on RBI Floating Rate Savings Bond

- The bond carries a floating rate of interest

- The interest rate is linked to the National Savings Certificate (NSC) rate, with a spread of 0.35%

- The interest rate is reset every six months (January 1 and July 1)

- Interest rate on the National Savings Certificate (NSC) is 7.7% at present. Thus RBI Floating Rate Savings Bond carries an interest rate of 8.05% (7.70+0.35) at present.

Interest is paid semi-annually, ensuring a steady income stream for investors.

Taxation – RBI Floating Rate Savings Bond

- Interest earned on RBI Floating Rate Savings Bonds is fully taxable

- Interest income is taxed as “Income from Other Sources”

- There are no tax benefits under Section 80C or any other section of the Income Tax Act

Tax Deducted at Source (TDS)

- TDS is applicable on interest payments as per prevailing income tax rules

- Investors can submit Form 15G or Form 15H (eligible investors) to avoid TDS deduction

Form of Holding

The bonds are issued in dematerialised (demat) form only and are credited to:

- RBI’s Retail Direct Gilt (RDG) account, or

- An account maintained with a designated bank or institution

No physical bond certificates are issued.

Application Process

Investors can apply through:

- Designated banks

- RBI’s Retail Direct online portal

The application involves:

- Filling in personal and KYC details

- Choosing the investment amount

- Making payment via electronic modes or bank transfer

Nomination Facility

- Nomination facility is available

- Investors can nominate one or more persons

- Nomination can be added, changed, or cancelled during the tenure of the bond

Repayment & Maturity

- The bond has a tenure of 7 years

- Premature redemption is allowed for senior citizens, subject to a minimum lock-in period:

- 60–70 years: after 6 years

- 70–80 years: after 5 years

- 80 years and above: after 4 years

- On maturity, the principal amount is repaid in full

Key Features at a Glance

- Government-backed, low-risk investment

- Floating interest rate linked to NSC

- Semi-annual interest payout

- No maximum investment limit

- Demat-only holding

- Taxable interest income

Conclusion

The RBI Floating Rate Savings Bond is a suitable investment choice for individuals looking for capital safety and regular income, particularly retirees and conservative investors. While it does not offer tax benefits and interest is taxable, the government guarantee and floating interest structure make it an attractive option during fluctuating interest rate cycles.

Investors should assess their tax bracket and liquidity needs before investing, but for those prioritising safety and predictable returns, this bond remains a reliable long-term option.