Last updated on October 9th, 2023 at 01:01 pm

Positive Pay System (PPS) is an additional security authentication introduced for preventing Cheque related frauds in high value transaction.

You might have heard about the PPS from your bank through branch, SMS, Website of your bank or at through the ATM’s. But do not understand what is PPS and how it works this post will help you understand the basics features of PPS.

What is PPS for High Value Cheques?

Reserve Bank of India (RBI) has introduce Positive Pay System for the Cheque Truncation System (CTS). Positive Pay System was implemented from 1st January, 2021.

Thus for any cheque to get cleared through CTS, the drawer of the cheque must provide the basic details of the cheque issued to the Bank.

Need for PPS

With the advent of the digital Transactions we have seen a decreace in the usage of Cheque transaction in recent times.

But for the business persons and who are not tech savy and use the Cheque as their primary transaction, it is important to safeguard the transaction.

As the Cheques are really easy to manipulate and there is no additional factor used for the CTS transaction, it is prone to fraud transaction.

Thus to avoid such issues RBI comes up with the PPS for authenticating the transaction with the details provided in PPS mandate.

Is PPS Mandatory?

No, It is not mandatory for the customers to submit the Cheque Details through PPS. It is only submitted through the discretion of the customer upto Cheque values less than 5 lakh.

But for the transaction of Rs. 5 lakh and above the banks can choose to make Positive Pay System mandatory or not.

When to Submit PPS request?

As per RBI circular DPSS.CO.RPPD.No.309/04.07.005/2020-21 dated September 25, 2020, The banks mandatoryly have to create a system for capturing PPS for the cheques presented at CTS with a value of Rs. 50,000 and above.

Thus you can give a Positive Pay System request on the following situations

| Amount | PPS Request |

| Less than Rs. 50,000 | Not Eligible for PPS request |

| Rs. 50,000 to Rs. 5,00,000 | Can Submit a Request at the Customers own Discretion |

| More than Rs. 5,00,000 | At Banks Discretion it can be mandatory or not |

Minimum Amount for PPS

Thus Positive Pay System can be availed for the Cheques in CTS for transaction value of Rs. 50,000 and above.

The minimum limit is set so as to avoid inconvenience to the customers for the low value transaction.

Details Needed for PPS Request

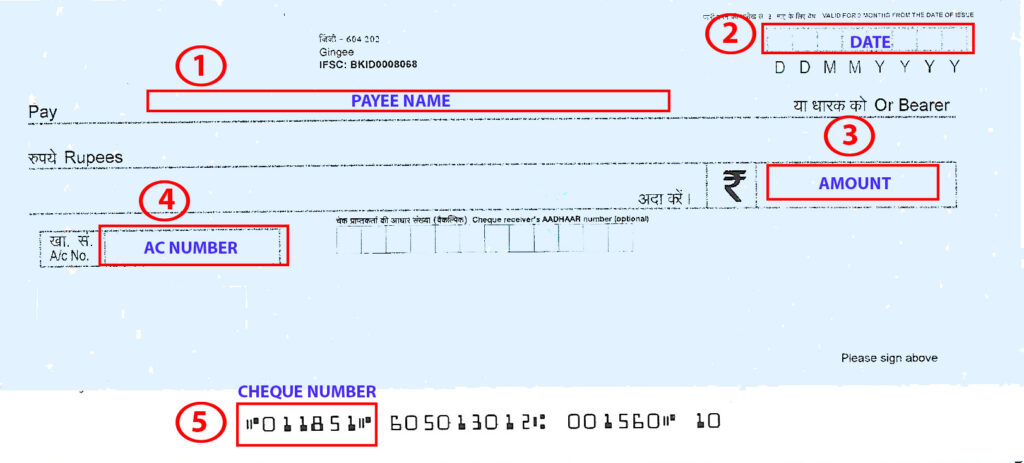

While giving the request for PPS the following details of the cheque issued to the payee need to be provided.

- Payee Name

- Cheque Date

- Amount

- Your Account Number

- Cheque Number

But, It is important to provide a correct details, make sure all the details are correct and without any spelling mistake to avoid rejection of the cheque.

The details required may vary from bank to bank, but the above details are enough to provide the details to the bank.

Channels Available for Mandate Request

All banks are mandatoryly provide the PPS service through the following modes.

- Branch – You can give a request through your branch by providing physical application with the details authorizing with your signature.

- Mobile Banking/Internet Banking – You can also issue mandate through Mobile Banking and Internet Banking. Enter all the details and submit and you will be prompted for transaction password for authentication.

- SMS – Positive Pay System mandatate can be issued through SMS in the format provided by your bank. The format can be obtained from the branch or from the official website of your branch. Note that the SMS have to be sent from registered mobile number of your account.

Conclusion

Thus with the introduction of PPS it become more safe to do transaction with Cheques. For the business persons who still do the transaction through Cheques this system provides additional securtiy.

Though Positive Pay System has an additional work to be done, it is really worth it as it is only required for the high value transaction safeguarding your money.