Last updated on October 9th, 2023 at 01:00 pm

Credit Card and Debit Card are both a payment instrument provided by Financial Institutions like banks and authorized private institutions.

Though both looks the same used in the same manner, the functionality and how the service provided by banks differs.

In this post we will discuss on the features and functionality of both credit and debit card. Read further for more details.

What is Debit Card/ ATM Card?

Debit Card is the basic payment card. If you are having a bank account you probably have a Debit Card linked to your account.

The Debit Card provides safe and alternative way of payment to merchant on POS, for online payments and withdrawal of cash from ATM.

The debit card is linked with your Bank Account (Savings/ Current). Thus if you make a payment using debit card, you are debiting your account for payment.

So if you you try to make payment without sufficient balance in your account, the bank will reject the payment.

Features of Debit Card

Debit Card has following important Features

- You can get a Debit Card only if you have a operative account (Savings/ Current Account) with the bank.

- You Can apply for multiple Cards for the same account.

- The Spending limit is equal to the balance available in the bank account.

- There is an Annual Maintenance Charge for the Debit Card but it is comparatively lower than Credit Card. There is limitation on cash withdrawal in ATM, if the transaction exceeds the limitation charge is levied on account.

- There is no additional fees and charges for doing transactions.

What is Credit Card?

Credit Card is a facility provided to customers by banks and sanctions specific limit to customer as per their income criteria. Thus the card holder can pay for goods and services with in the sanctioned limit.

Credit Card also provides payment through POS, online payment and contactless payment. You can also withdraw cash from ATM, if required.

But the limit sanctioned is for the period of one month. Thus after generating the monthly bill the customer has to pay the billing amount on due date to avail interest free Credit Period.

For more details and understanding of Credit Card and how to use it read our blog on Credit Card.

Features of Credit Card

- Banks, Financial institutions and authorized private companies are issuing debit card.

- Income and credit worthiness of the customers decides the maximum limit for the card.

- There is a high issuance charges and Annual Maintenance Charges compared to the Debit Card.

- There is a higher Reward Points provided for usage of the card. Thus Credit Card provides credit to the user on all the transaction.

- You can apply for an Add On cards, which is an additional card issued with in the sanctioned limit.

- The interest is levied on the amount utilized if not paid on the due date.

- The you fail to make a payment on time it will hit your credit score. But the proper use and timely payment of credit card bill will improve your credit history and credit score.

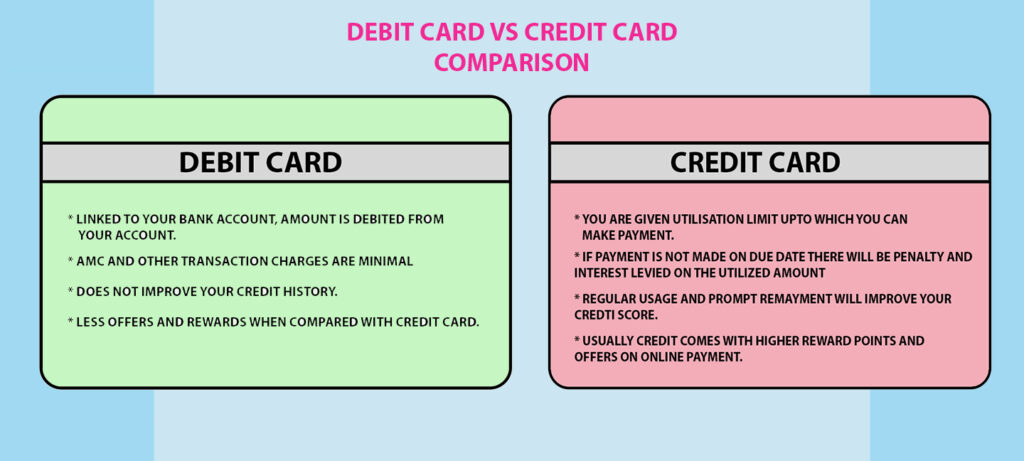

Debit Card VS Credit Card Comparison

| Debit Card | Credit Card |

| Debit Card is linked to your operative account. Your account gets debited when you use your account. But there is a daily spending limit based on the card. | You have been given a Spending Limit For the month. You can utilize the card upto this limit |

| As the amount is debited from account there is no need for payment | The amount utilized in the month has to repaid before the due date provided on the monthly bill |

| Charges or Interest is not levied on the amount utilized. | If amount is not paid on the due date, you have to pay interest on the amount utilized. |

| Does not affect or improve the credit score | Proper usage and prompt repayment will improve the credit score and enhance the chances of future loan approvals |

| Reward and Offers on Debit Card transaction is minimal | There is more Rewards and Offers with Credit Card provided by Card issuer and Merchants |

Conclusion

Both Debit Card and Credit Card is used in the same way for payment for user. But each have their own Pros and Cons, choosing between the two type is based on the requirement of each individual.

Credit Card provides easy access to fund and gives ample time for repayment without any charges and improves your credit score. But if miss the due date or used the card more than your repayment capacity it will drain more money from you through charges and interest.

In the Other hand the Debit Card does not offer these facilities, but it will make you a disciplined spender of your money.

To summarize the card can be used by any one without any worry. But if you want to go for a credit card know all the features and Cons of the Credit Card before start using.