Last updated on October 11th, 2023 at 04:07 pm

Atal Pension Yojana (APY) is a pension scheme introduced by Indian Government to provide retirement benefit for the labors in unorganized sectors and daily wagers.

What is Atal Pension Yojana

Atal Pension Yojana (APY) was introduced in 2015 by Government as part of Financial Inclusion plan.

APY is introduced to provide financial stability after retirement for workers in unorganized sectors and daily wagers.

It also covers private sector employees to whom there is no retirement benefits provided by their employers.

The objective of Atal Pension Yojana Scheme is to provide every citizen with financial stability after retirement.

Eligiblity

For subscribing to the Atal Pension Yojana a person should fulfill following eligibility criteria.

- Subscriber should be an Indian Citizen.

- Age should be betwee 18-40.

- Subscriber should have a Bank Account.

- Subscriber should have Aadhar for KYC verification.

Who are not Eligible

- Person who is not Indian citizen.

- Person who is availing other social security scheme.

- Person who is an Income Tax payer.

How to Apply

As of now the subscription to Atal Pension Yojana can be availed only at the respective bank where you have your account.

You can get the application for APY subscription from the official bank website or at the branch.

You can fill the form with the necessary details like your Account Number, Mobile Number, Pension amount, Premium frequency, Spouse Name and Nominee details.

Submit the application to the bank official.

Ensure you have sufficient balance in your account for payment of initial contribution payment.

Your request will be processed with in one or two days. You will be allocated with the PRAN number.

Consequently your savings account will be debited for the initial premium.

You can get a acknowledgement for APY subscription from the respective branch.

Pension and Contribution Options

Atal Pension Yojana scheme provides five pension option for subscription i.e., Rs. 1000, Rs 2000, Rs 3000, Rs 4000 and Rs 5000.

Premium is paid Monthly, Quarterly, Half yearly or Yearly as per your convenience.

How to Make Contribution

Contribution to Atal Pension Yojana is debited from subscriber’s account on the due date as per the request provided in the application.

How does APY Work?

When you make a contribution towards APY, bank will move the fund to Pension Fund Regulatory and Development Authority (PFRDA).

PFRDA manages the fund under National Pension Scheme (NPS). The funds are invested in various securities like equity and Debt securities.

The pension option provided as above are the guaranteed pension amount.

If the investment gives higher return, subscriber will get the higher pension and corpus amount than the guaranteed amount.

Penalty for Delayed Contributions

If you failed to pay your contribution on time there will be penalized by your bank as below

| S.No | Contribution | Penalty per Month |

| 1 | upto Rs.100 | Rs. 1 |

| 2 | Rs. 101 – Rs. 500 | Rs. 2 |

| 3 | Rs.501 – Rs. 1,000 | Rs. 5 |

| 4 | Rs.1,001 and above | Rs. 10 |

If you failed to pay your contribution for more than 6 months your Atal Pension Yojana Account will be frozen.

After 12 months of non payment of contribution the APY account is closed. Balance amount after deducting penalty is credited to the account.

Premium Chart

Premium paid to the Atal Pension Yojana scheme is depends upon two factors

- Age of the Subscriber – As the contributions made till the subscribers attains the age 60, person subscribing at the younger age will pay for a longer term. Hence he will pay lesser premium compared to the older person.

- Amount of Pension Requested – Premium will be higher for the people opting for higher premium.

| Age of Entry | Years of contribution | Pension Rs.1000 | Pension Rs.2000 | Pension Rs.3000 | Pension Rs. 4000 | Pension Rs. 5000 |

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 30 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| Return Corpus | – | 1.7 lakh | 3.4 Lakh | 5.1 Lakh | 6.8 Lakh | 8.5 Lakh |

| Return Corpus | – | 1.7 lakh | 3.4 Lakh | 5.1 Lakh | 6.8 Lakh | 8.5 Lakh |

Atal Pension Yojana Benefit

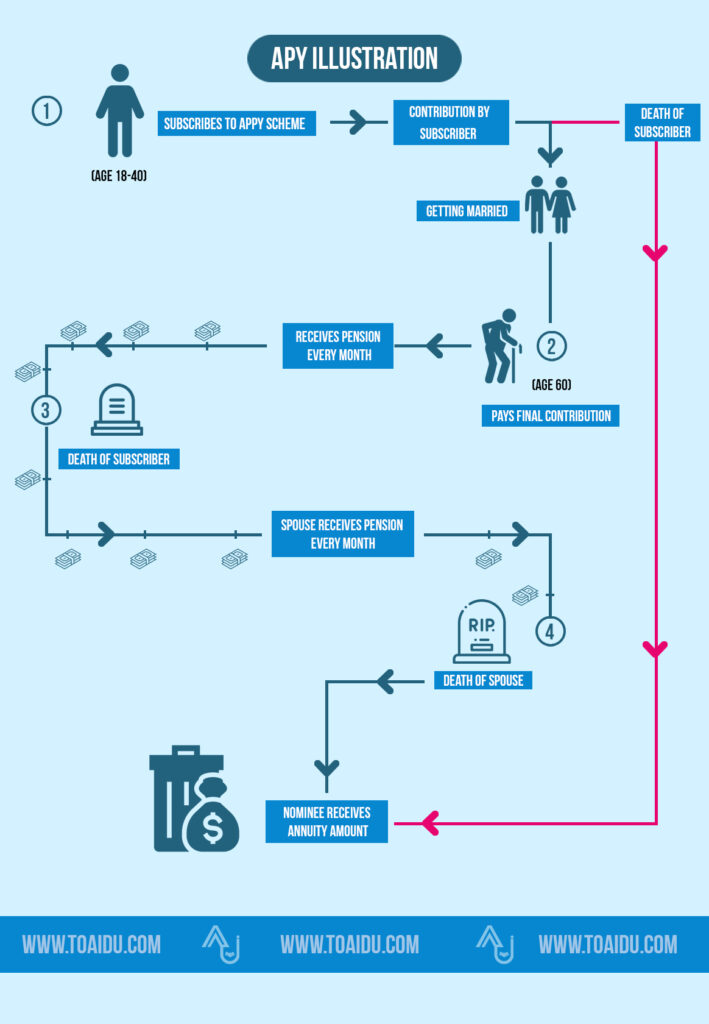

Subscriber will get monthly pension after attaining the age of 60 years. On the death of subscriber the spouse of the subscriber will also gets the pension for the life.

After the death of spouse the corpus amount is paid to the Nominee of Atal Pension Yojana scheme.

If Subscriber dies before attaining 60 years age, the spouse can either avail for the corpus amount or continue paying the contribution and get the pension after the end of contribution payment term as per their spouses age.

After the death of the spouse the corpus amount is paid to the nominee.

Atal Pension Yojana (APY) Tax Benefits

For the amount invested in Atal Pension Yojana, You can claim upto Rs. 1.5 Lakh tax deduction under section 80CCD (1).

And also additional investment of up to Rs. 50,000 is eligible for tax deduction under section 80CCD (1B). Thus you have can claim maximum Tax Benefit of Rs. 2 Lakh with APY contribution.

But note that you can claim maximum of Rs. 2 Lakh deduction under Section 80C and 80CCD combined.

Pre closure/ Early withdrawal

Preclosure of the Atal Pension Yojana is not generally allowed.

The closure of APY can only be done on the death of the subscriber.

But the subscriber can do voluntary Exit from the scheme any time, if they are unable to pay the premium or for any other reason.

On voluntary exit from the scheme only the contributed amount is paid back to the subscriber. Any return obtained by investment is not paid back to the subscriber.

Important Features of Atal Pension Yojana

- A Person can avail only one Atal Pension Yojana subscription.

- Pension amount availed can be Upgraded or Downgraded at any time as per the requirement.

- As the contribution amount is invested debt and equity securities like in the Mutual Fund, It is most likely to provide good returns.

- Atal Pension Yojana provides assured benefits to both the subscriber and their family after retirement.

Conclusion

Atal Pension Yojana is really beneficial for the people who are working in unorganized sectors and Daily wagers by aiding them in the post retirement life.

Apart from providing retirement benefit for the subscriber it also covers the family by providing generous corpus amount to the nominee.

Useful Information 💙